A phrase much used in the alternative fuels industry is the ‘chicken and egg problem’. Without demand for recharging and refuelling alternative-fuel vehicles there is no case for investment in infrastructure; but without infrastructure to recharge/refuel them, most people will not buy alternative fuelled vehicles. There is a solution to this problem, but it requires action from both the public and private sectors, new and innovative business models, and perhaps most importantly a long-term approach.

Alternative fuels for transport are coming. Oil is a finite resource and vehicles fuelled with oil derivatives such as petrol and diesel emit pollutants which harm both the environment and human health. Facing this issue, transnational governmental institutions such as the European Commission – as well as national governments – are setting policy and regulatory frameworks to encourage and mandate greater use of alternative fuels. They are investing to support deployment of the recharging and refuelling infrastructure needed to service the growing fleet of vehicles running on alternative fuels such as electricity, compressed natural gas (CNG), liquefied natural gas (LNG) and hydrogen.

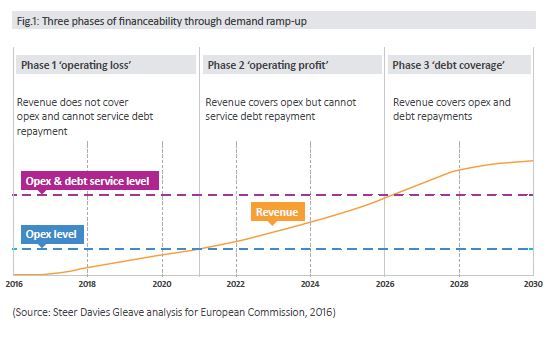

But wide scale provision of the necessary infrastructure requires significant investment to provide enough geographical coverage to reduce user anxiety about the availability of recharging and refuelling options. However, the current proportion of the vehicle fleet that runs on alternative fuels is small, and the revenues from the sale of charging, CNG/LNG or hydrogen are not enough even to cover infrastructure operating costs, never mind financing costs, or to generate a return on the capital investment. (see Fig.1)

For this reason, the deployment and operation of alternative fuel infrastructure is currently funded through either public sector grants or benevolent or speculative private sector investors. It is not a business that can currently operate commercially (as depicted by Phase 3 in Fig.1) but it needs to be one, if the transition from conventional fuels to alternative fuels is to be achieved at scale and within a timeframe consistent with achieving international policy objectives on decarbonisation.

Making forecasts of demand for alternative fuels in transport is extremely challenging, because large scale change is likely to happen only when policy, regulatory and economic incentives combine to make buying an alternative-fuel vehicle the sensible choice for most people. This will involve addressing the risks related to the residual value and running costs of new alternative-fuel vehicles for consumers. However, most industry estimates suggest a significant uptake in demand from the mid-2020s onwards.

Our work for the European Commission shows that conventional business models for infrastructure deployment and operation will become commercially viable for electric charging at a similar time, with other alternative fuels following by the late 2020s or the 2030s. To get to that point, however, either the chicken and egg problem needs to be solved or massive public sector or benevolent investment will be needed, to deploy and support the infrastructure whilst the demand is negligible.

Innovators are looking for ways to break the egg. One of the most promising new business models we have investigated is the ‘Tied Vehicle & Infrastructure’ or ‘Captive Fleet’ model. This provides guaranteed demand for alternative fuels from a vehicle fleet, which improves the business case for investment in the infrastructure. This is achieved through a contracting arrangement that brings together guaranteed fuel purchase with infrastructure deployment and also (optionally) vehicle purchase/leasing. Such projects can bring benefits to a number of stakeholders by making the infrastructure available to both the captive fleet and the public.

By removing one part of the chicken and egg problem – the availability of infrastructure – one of the key barriers to consumer demand for alternative fuelled vehicles is removed. The introduction of alternative-fuel vehicles in captive fleets can both reduce fleets’ greenhouse gas emissions and costs, and raise awareness of cleaner technologies, thereby contributing to multiple public sector objectives.

These business models are suitable for many different types of fleet, and particularly suit fleets based in urban areas which may be fuelled at a single location. Public sector fleets such as local council vehicles like refuse/garbage vehicles, health service vehicles, and taxi and bus fleets (both publicly and privately operated) would often be suitable. Our work suggests a commercial business model for investment for even relatively small fleets of 50-100 vehicles (depending on the background public demand, fleet usage profile and fuel type).

The opportunity exists to develop Captive Fleet projects now, where public sector (local/regional authority) partners are willing to facilitate and potentially co-sponsor projects and where fleet operators (either public or private) are willing to be involved. Depending on the contracting structure, such projects could be carried out almost entirely in the public sector (with a public sector fleet operator and public sector funding/financing). However, PPP structures would also work, and could include private sector bus or other fleet operators (such as logistics), recharging/refuelling infrastructure providers, energy/fuel providers, fleet providers or manufacturers, and financers.

These projects would be particularly suited to including vehicle purchase/leasing arrangements as part of the contract, with financing structured to avoid large upfront payments for new fleets and reduced fleet costs associated with sizable fleet orders.

A phased approach to deployment of alternative-fuel infrastructure is needed. By using innovative business models such as the ‘Captive Fleet’ now, a backbone of infrastructure can be built up, starting at key urban locations, stimulating public demand and operating on a commercial basis.

Partnership between the public and private sectors will be needed, along with financing instruments tailored to support projects structured in this way. As public demand for alternative fuels grows, conventional models of infrastructure deployment and operation will become viable, and further infrastructure rollout at densely-trafficked areas – such as in urban areas or at transport nodes – can be accomplished on a commercial basis.

Finally, infrastructure will be required on motorways and major roads, enabling interurban and even international travel. Even with mature demand in some areas, public sector intervention is likely to be required with partnership between motorway service area operators, the alternative fuels industry and national/regional government agencies, coordinated at European level to avoid a fragmented network and to ensure full alternative-fuelled mobility.

Steer Davies Gleave will soon be presenting the results of a major study funded by the European Commission into innovative business models and financing solutions for the deployment of alternative fuels infrastructure at a conference organised by the European Commission and the European Investment Bank in Brussels.