Governments throughout Europe and around the World have targeted a hefty expansion in the number of publicly available electric vehicle (EV) charge-points. Implied in these mandates is the attraction of substantial private investment to an emerging asset class.

In advising clients on their consideration of EV-related investments, we’ve noticed their engagement with some critical and recurring themes impacting the "go-no-go" decision:

Anticipating Demand

In general, investors acknowledge that demand for charging infrastructure is a function of government mandate and therefore somewhat predictable.

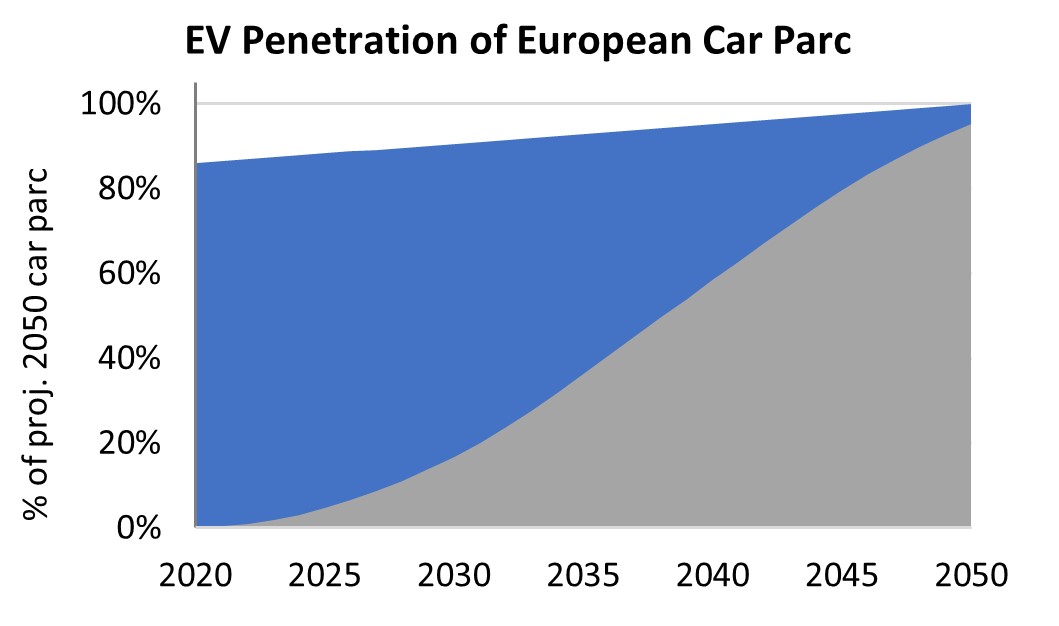

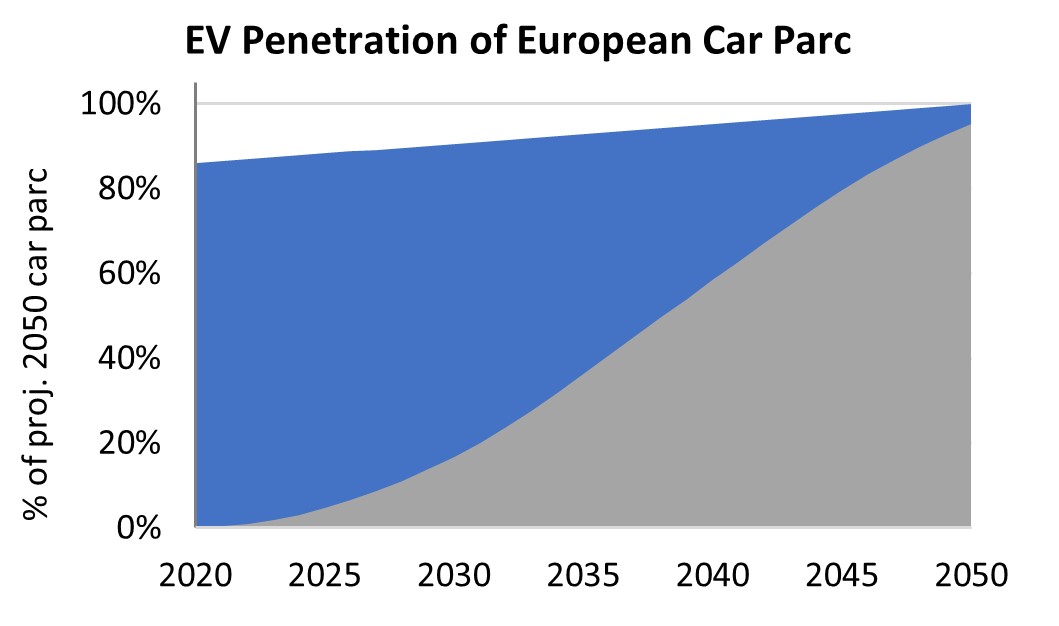

Penetration of EVs within the Global car parc is a function of:

- Mandated penetration of EV within new car sales (100% by 2035 throughout the EU) and

- Expiration of the useful life of incumbent diesel and petrol-powered cars.

However, the investability of any specific project demands a much more nuanced view as to where demand will emerge, when it will emerge, and what sorts of infrastructure will be demanded. For this "deeper dive", we engage Steer’s extensive background in traffic & revenue forecasting, tempered by our observation of:

- Market factors (including manufacturers’ distribution strategies),

- Geographic factors (e.g., housing densities and traffic flows, etc) and

- Demographic & other socio-economic factors.

Projecting Supply

Drivers demanding EV charging will make their purchase selection based on convenience, customer experience, and cost. Therefore, the scale and predictability of cash flows associated with any charging infrastructure project depend on management’s efficiency in five fundamental activities:

- Securing operating rights at high-potential locations,

- Installing and maintaining chargepoint hardware,

- Securing dependable wholesale energy supply at favorable pricing,

- Assuring a positive customer experience and

- Undertaking back-office operations.

Each project’s’ ability to attract revenue and create value relies on its performance against each of these five factors. For example, the securing of good operating permissions requires a deliberate and sustained effort in evaluating locations, establishing relations with landowners, negotiating, confirming business terms, and closing deals. Similarly, the assurance of customer experience requires committed investment in supportive technology around finding, booking, and paying for charging sessions.

A specific subset of EV charging business models mitigates certain commercial risks. Public transport (e.g., electric buses) and commercial fleet projects often feature contractual off-take commitments. Often, well-established commercial real estate operators can both demonstrate established consumer behavior (i.e., supermarkets and retail parks, etc.) and contractually defray some commercial risk themselves.

Three Key Variables

In our transaction advisory practice, we’re increasingly seeing business models that task management with challenging targets in three areas:

Estate Expansion

Dynamically accelerate the pace at which management identifies premium locations, secures operating rights, and cost-effectively installs incremental charge-points.

Utilization Improvement

Attract a disproportionate share of charging customers in an expanding EV parc to the project’s installed infrastructure.

Price Margin

Retain pricing so as to maintain a healthy margin over the wholesale cost of electricity sold.

Conclusion

Demand for EV charging infrastructure is imminent, predictable, and sizeable. This emerging asset class will be with us throughout the intermediate future, soaking up a sizeable portion of infrastructure finance.

While it is investable as a function of the scale and predictability of associated cash flows, those considering investment in EV infra projects must consider the ability of management to address those five fundamental activities in creating infrastructure that attracts demand as a function of its price, it's convenience, and the quality of the customer experience created.