Acknowledging both the 2030 prohibition on the sale of new diesel and petrol-powered cars (ICE) by the EU, UK, many American states, and other governments around the world and the average useful life for an ICE of about 20 years, we should expect nearly 100% fleet electrification by 2050.

Expanding this curve to our global car parc, some simple calculations indicate that the World may require $1.5 trillion of investment in EV charging infrastructure by 2050. From an investor’s point of view, the commercial viability of that infrastructure relies on a robust projection of where demand will emerge, when it will emerge, and specifically what types of charging infrastructure will be demanded.

Market Segmentation Better Defines the Where and When of Emerging Demand

To date, much of the EV adoption in the UK has exploited a subsidy within tax-efficient company car and salary sacrifice schemes. Not surprisingly, the EV penetration of company-registered cars here is 9x that of privately registered cars.

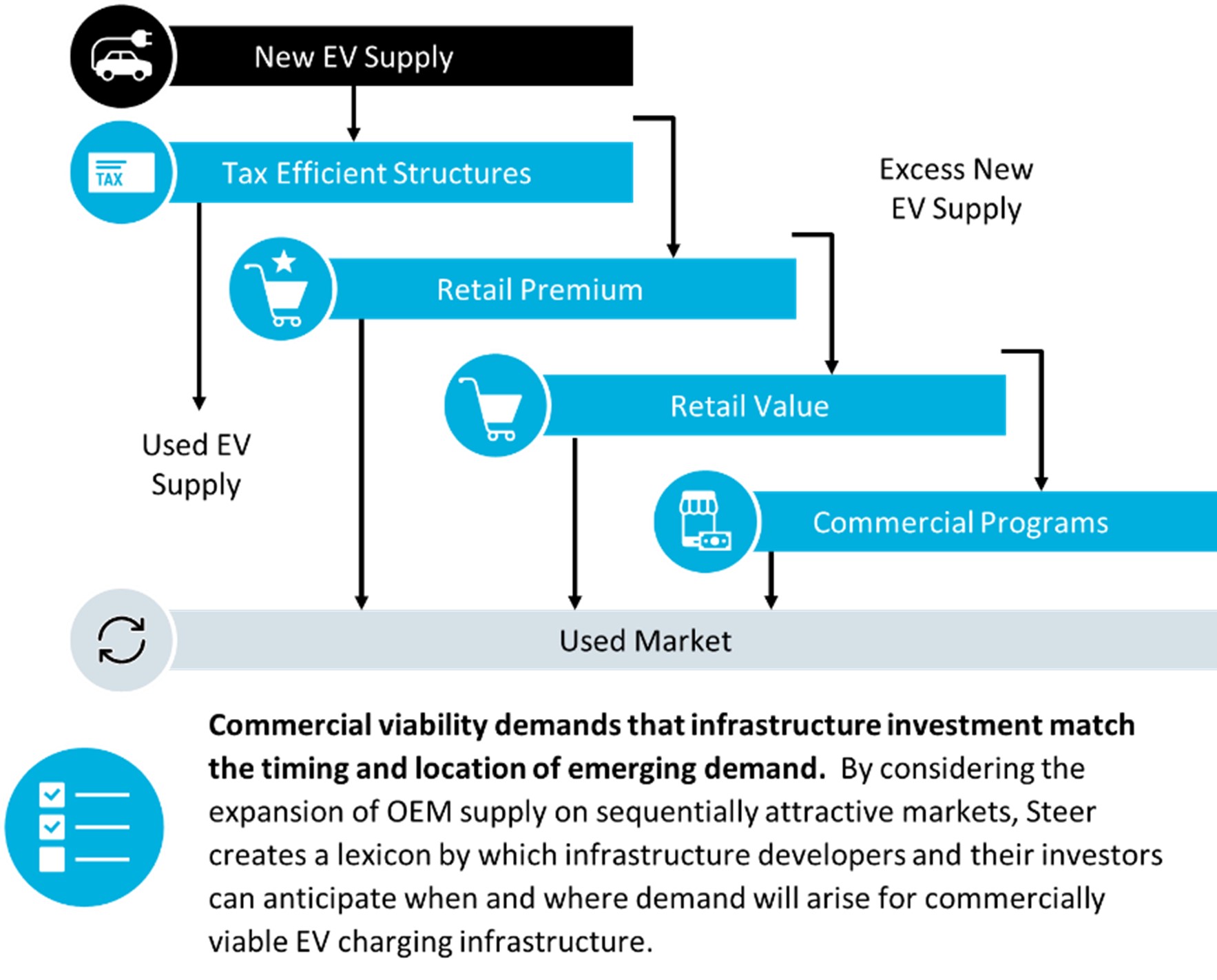

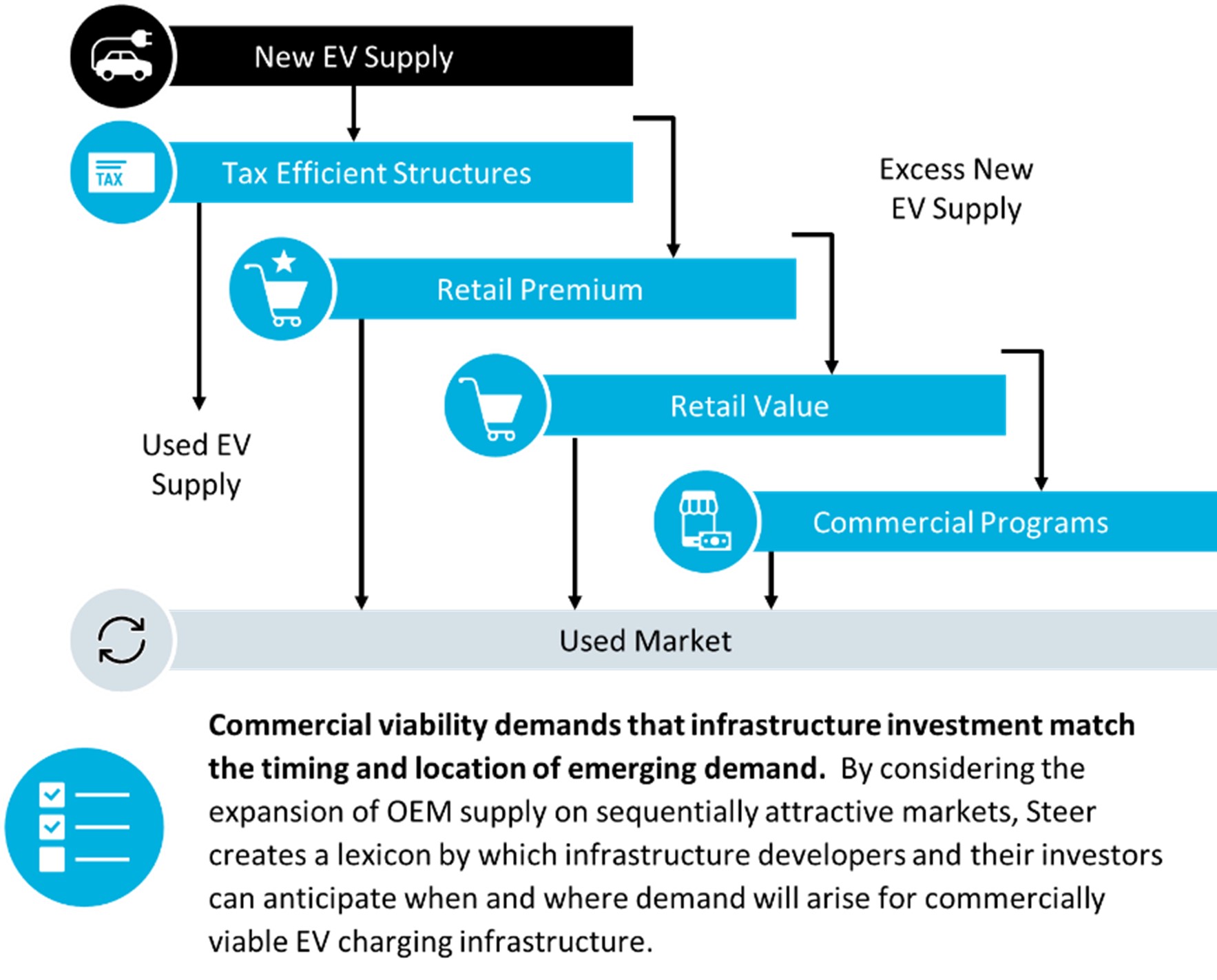

As growing EV production outstrips demand from these tax-efficient structures, manufacturers will re-direct excess supply through a cascade of decreasingly profitable market segments. “Premium” and then “value” retail segments attract supply before lower-margin commercial programs (e.g., car rental fleets, etc). Finally, used markets emerge as new EVs cycle through their initial owners.

Discreet characteristics of these market segments shed particularly useful light on the “where” and “when” of emerging demand. As an example, tax-efficient and premium retail drivers tend to display higher levels of household income and enjoy better access to off-street parking with convenient and inexpensive residential charging. Their “first mover” adoption of EVs and wider access to private charging resources delays demand for public charging resources, particularly within identifiable residential neighbourhoods.

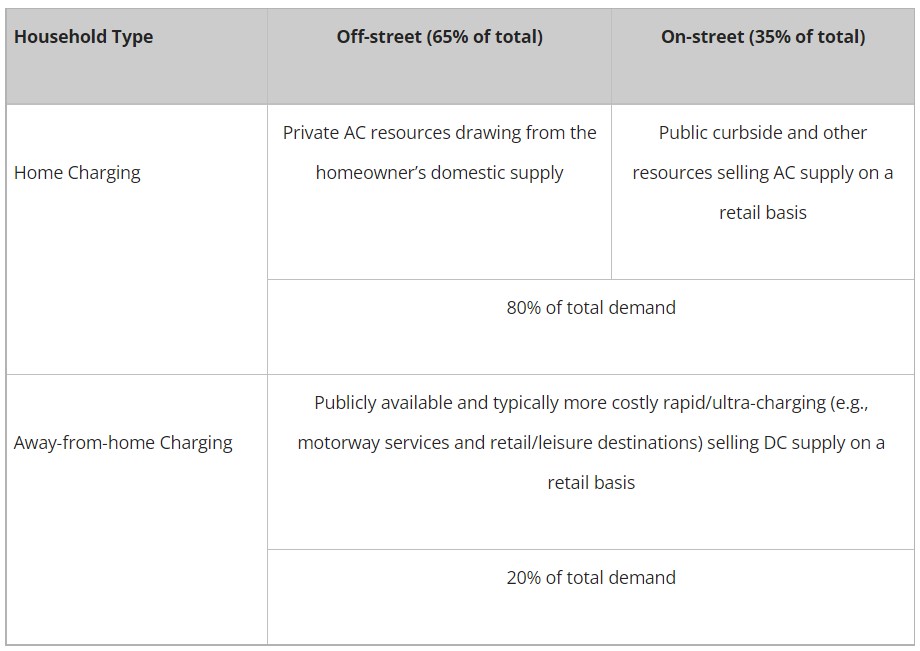

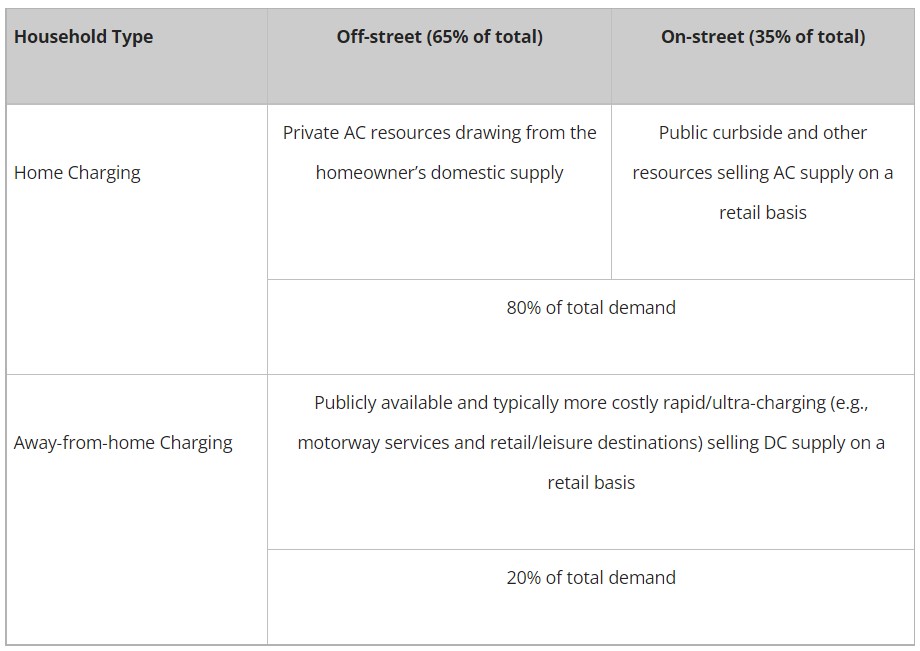

A Simple but Crude Lexicon of EV Charging Resource

Impact for Investors

Developers of commercially viable EV charging infrastructure must decipher where demand will emerge, when it will emerge, and what types of infrastructure will be demanded. Mandated by government regulation, the pace of EV adoption drives such demand, and by considering manufacturers’ segmentation strategies, investors gain access to a more nuanced predictability of the location and timing of demand for charging infrastructure.

By translating the real-world experience of EV charging into financial return metrics, we help define this emerging asset class that will attract huge investment from both equity and more structured vehicles through the next several decades.